The Of Neutralizing Pet Odors

Wiki Article

The Greatest Guide To Neutralizing Pet Odors

Table of ContentsGet This Report on Neutralizing Pet OdorsSome Ideas on Neutralizing Pet Odors You Should KnowExamine This Report about Neutralizing Pet OdorsSome Ideas on Neutralizing Pet Odors You Need To Know

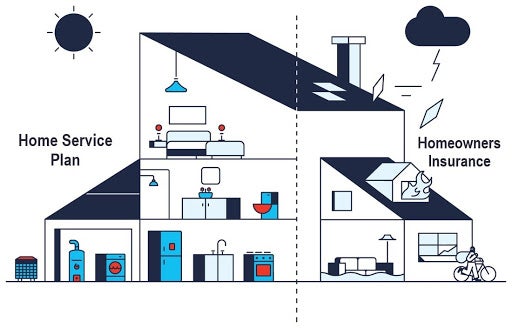

Have you ever wondered what the distinction was in between a house warranty and home insurance? Both shield a home and a home owner's pocketbook from expensive repair services, however just what do they cover? Do you require both a residence service warranty and also home insurance policy, or can you obtain just one? All of these are superb inquiries that lots of property owners ask.

What is a house service warranty? A residence warranty shields a residence's internal systems and home appliances. While a home guarantee agreement resembles house insurance policy, especially in just how a home owner utilizes it, they are not the exact same thing. A property owner will certainly pay an annual costs to their home guarantee business, usually in between $300-$600.

If the system or device is covered under the home owner's residence guarantee strategy, the residence guarantee business will certainly send a contractor who focuses on the repair work of that specific system or appliance - neutralizing pet odors. The home owner pays a level rate solution call fee (typically between $60-$100, depending upon the house service warranty business) to have the contractor concerned their house and also diagnose the problem.

The Ultimate Guide To Neutralizing Pet Odors

What does a house warranty cover? A home service warranty may also cover the larger devices in a house like the dish washer, oven, fridge, clothes washer, as well as clothes dryer.For instance, if a commode was leaking, the home guarantee company would certainly pay to take care of the commode, but would certainly not pay to fix any type of water damage that was triggered to the structure of the home due to the dripping commode. Thankfully, it would be covered by insurance. What is residence insurance coverage? If a home owner has a mortgage on their house (which most homeowners do) they will be called for by their mortgage lending institution to purchase residence insurance coverage.

Home insurance policy may likewise cover clinical costs for injuries that people received by being on your building. When something is damaged by a disaster that is covered under the residence insurance coverage policy, a property owner will call their home insurance policy business to file a claim.

The 4-Minute Rule for Neutralizing Pet Odors

What is the Distinction Between Home Service Warranty as well as House Insurance Coverage A residence guarantee contract and also a residence insurance coverage operate in similar ways. Both have a yearly costs as well as an insurance deductible, although a residence insurance premium and insurance deductible is usually much higher than a house guarantee's. The primary differences between house guarantees as well as house insurance policy are what they cover.An additional distinction in between a residence guarantee and also home insurance coverage is that residence insurance is typically needed for house owners (if they have a mortgage on their home) while a house service warranty strategy is not called for - neutralizing pet odors. A house warranty and residence insurance policy give security on various components of a residence, and also with each other they can protect a home owner's spending plan from expensive repair work when they certainly surface.

If there is damages done to the framework of the home, the owner won't need to pay the high expenses to repair it if they have residence insurance coverage. If the damage to the home's framework or home discover this info here owner's possessions was produced by a malfunctioning home appliances or systems, a home service warranty can assist to cover the costly fixings or substitute if the system or appliance has actually failed from regular deterioration.

The Ultimate Guide To Neutralizing Pet Odors

"However, the extra systems you include, such as pool insurance coverage or an extra home heating system, the greater the cost," try this she states. Adds Meenan: "Rates are usually flexible as well." In addition to the annual cost, house owners can expect to pay typically $100 to $200 per solution call check out, depending on the kind of contract you acquire, Zwicker notes.House guarantees do not cover "products like pre-existing problems, pet invasions, or remembered items, describes Larson."If individuals don't check out or comprehend the protections, they may end up believing they have coverage for something they do not.

"We paid $500 to register, and afterwards needed to pay one more $300 to clean up the main sewage system line after a shower drain backup," states the Sanchezes. With $800 out of pocket, they believed: "We didn't take advantage of the home warranty at all." As a young pair in another home, the Sanchezes had a tough experience with a house service warranty.

When the technician wasn't satisfied with an analysis he obtained while checking the heater, they claim, the business would certainly not consent to insurance coverage unless they paid to change a $400 part, which they did. While this was the Sanchezes experience years ago, Brown validated that "evaluating every significant device before offering protection is not a market requirement."Always ask your supplier for quality.

Report this wiki page